THE CALIBER OPPORTUNISTIC GROWTH FUND LLC

Financial Professionals and Institutions

MULTI-FAMILY | COMMERCIAL | INDUSTRIAL

The Caliber Opportunistic Growth Fund LLC leverages the experience gained from Caliber's previous multi-asset developments to provide you with attractive risk-adjusted returns. The fund is purchasing a blend of development and value-add properties so that you can potentially receive distributions early in the fund's life cycle.

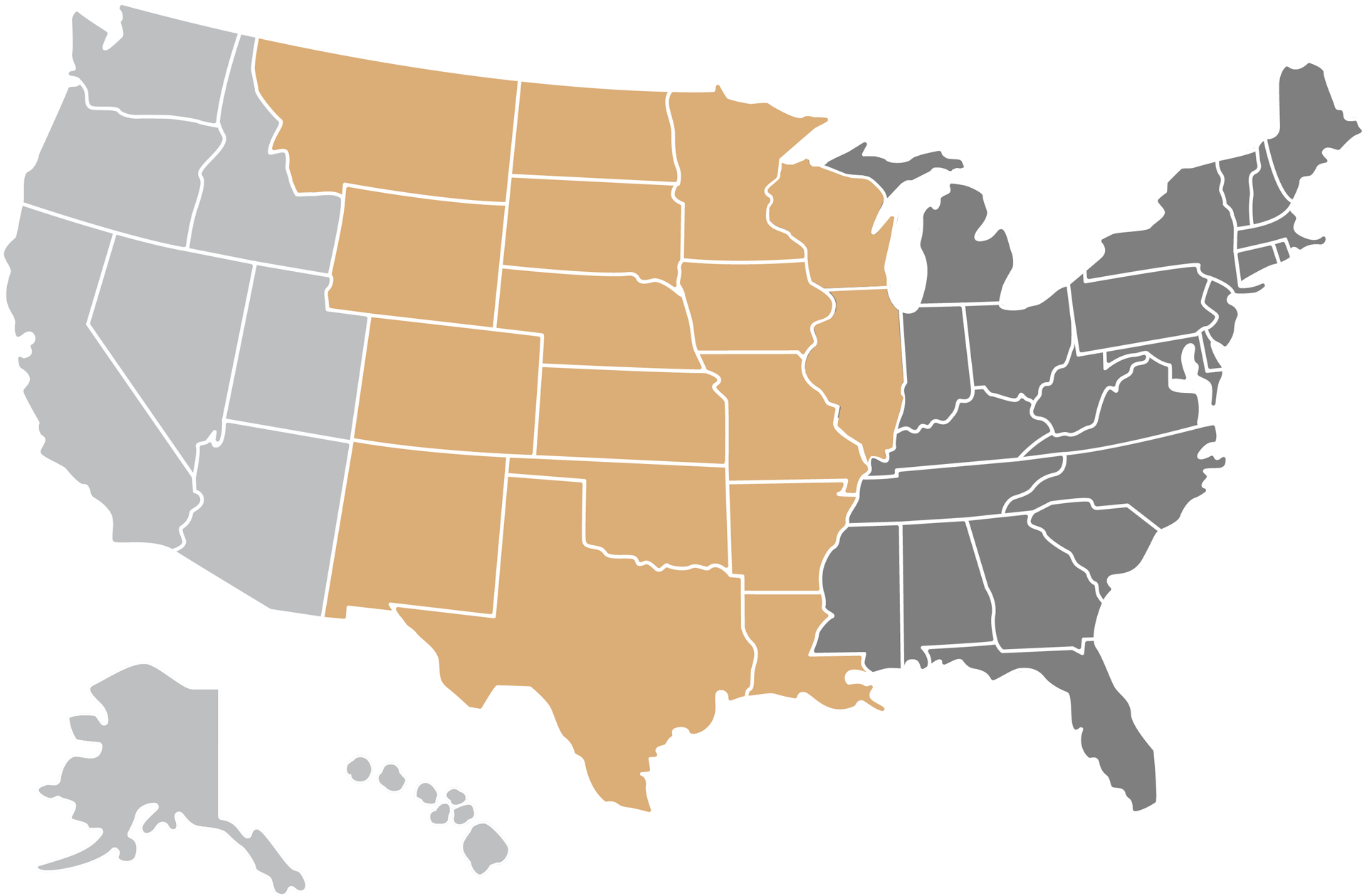

The fund seeks to own real estate in multiple markets, using a flexible investment mandate, Caliber is allowed to find opportunities using various real estate investment asset classes.

$250M

MAXIMUM OFFERING

$50K

MINIMUM INVESTMENT

POTENTIAL FUND ASSETS*

AS OF DECEMBER 2023

Norfolk Airport Hotel**

**Conceptual Rendering

NORFOLK | VIRGINIA

Multi-Family Asset

VARIOUS LOCATIONS | WEST US

Riverwalk Pure Pickleball**

**Conceptual Rendering

SCOTTSDALE | ARIZONA

Behavioral Health

DALLAS-FORT WORTH | TEXAS

Behavioral Health**

**Conceptual Rendering

OLATHE | KANSAS

*The following assets listed are identified as potential projects to live in the fund. These can be subjected to change due to numerous internal and external business variables that can potentially impact strategy, decision-making and other processes.

ABOUT THE PROGRAM

INVESTOR Considerations

Below are selected risk factors associated with an investment in the Caliber Opportunistic Growth Fund LLC.

- Investments in Caliber private placements can lose entire value, are illiquid and are speculative.

- Investment involves high degree of risk; limited liquidity; no public market; suitable only for sophisticated investors;

- Investment strategy is speculative; returns are not guaranteed and no assurance objectives will be achieved;

- May pay distributions and fund redemptions from borrowings, Offering proceeds, or asset sales with no limits on amounts it may pay from such sources;

- May invest in securities that involve a higher degree of risk or have valuations that fluctuate dramatically;

- Access to debt financing may be limited and subject to rate increases, restrictive covenants, or untimely repayment obligations;

- Involves unique risks associated with real estate investment, including competition for tenants, interest rate risk, occupancy issues, insurance risks, inflation risk, among others.;

- Offering is not contingent on a minimum capital raise;

- Multiple conflicts of interest, including compensation arrangements, incentive fee structures, positions held with affiliated entities, co-ownership arrangements, and the purchase of and allocation of investment opportunities;

- COVID-19 could have a material impact on the Fund’s investments and operations.

For a more complete discussion of risk factors, view the in the Caliber Opportunistic Growth Fund LLC PPM.

120-SKY-122023

Sign in or Sign up to view further offering details

Already have an account?

Log in Here

Speak to our VP of National Accounts

Overview Sheet

Please enter your information below to access the overview sheet.