Caliber Tax Advantaged

Opportunity Zone Fund II, LLC

Financial Professionals and Institutions

MULTI-FAMILY | COMMERCIAL | INDUSTRIAL

Caliber’s Tax Advantaged Opportunity Zone Fund II is specifically designed to give your clients the power to invest in attractive commercial real estate projects located within Qualified Opportunity Zones.

$250M

MAXIMUM OFFERING

$100K

MINIMUM INVESTMENT

CURRENT FUND ASSETS

AS OF DECEMBER 2023

Riverwalk Development

SCOTTSDALE | ARIZONA

Second Avenue Commons

MESA | ARIZONA

Mesa Portfolio

MESA | ARIZONA

29 W. Main ZenniHome*

*Conceptual Rendering

MESA | ARIZONA

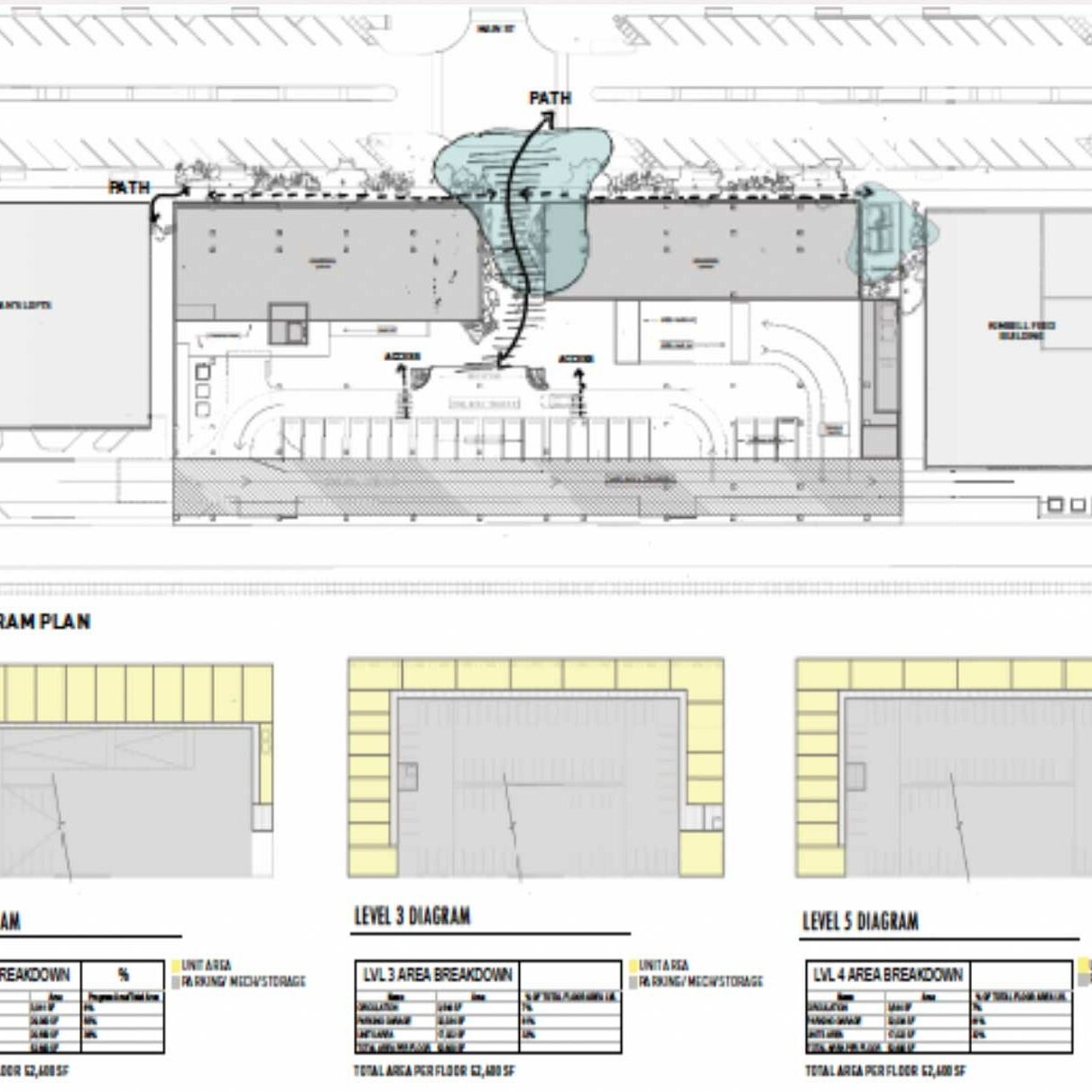

LORCA*

*Conceptual Rendering

BRYAN-COLLEGE STATION | TEXAS

POTENTIAL FUND ASSETS**

AS OF DECEMBER 2023

Riverwalk PURE Pickleball*

*Conceptual Rendering

SCOTTSDALE | ARIZONA

*The following assets listed are identified as potential projects to live in the fund. These can be subjected to change due to numerous internal and external business variables that can potentially impact strategy, decision-making and other processes.

HOW IT WORKS

The fund objective is to provide your clients with diversified exposure to real estate and the potential for significant tax benefits through the opportunity zone program.**

Caliber’s documented history of investing in mixed, discretionary private real estate funds has led the company to be recognized as a thought and market leader in opportunity zone investments as an early entrant in the space in 2018.

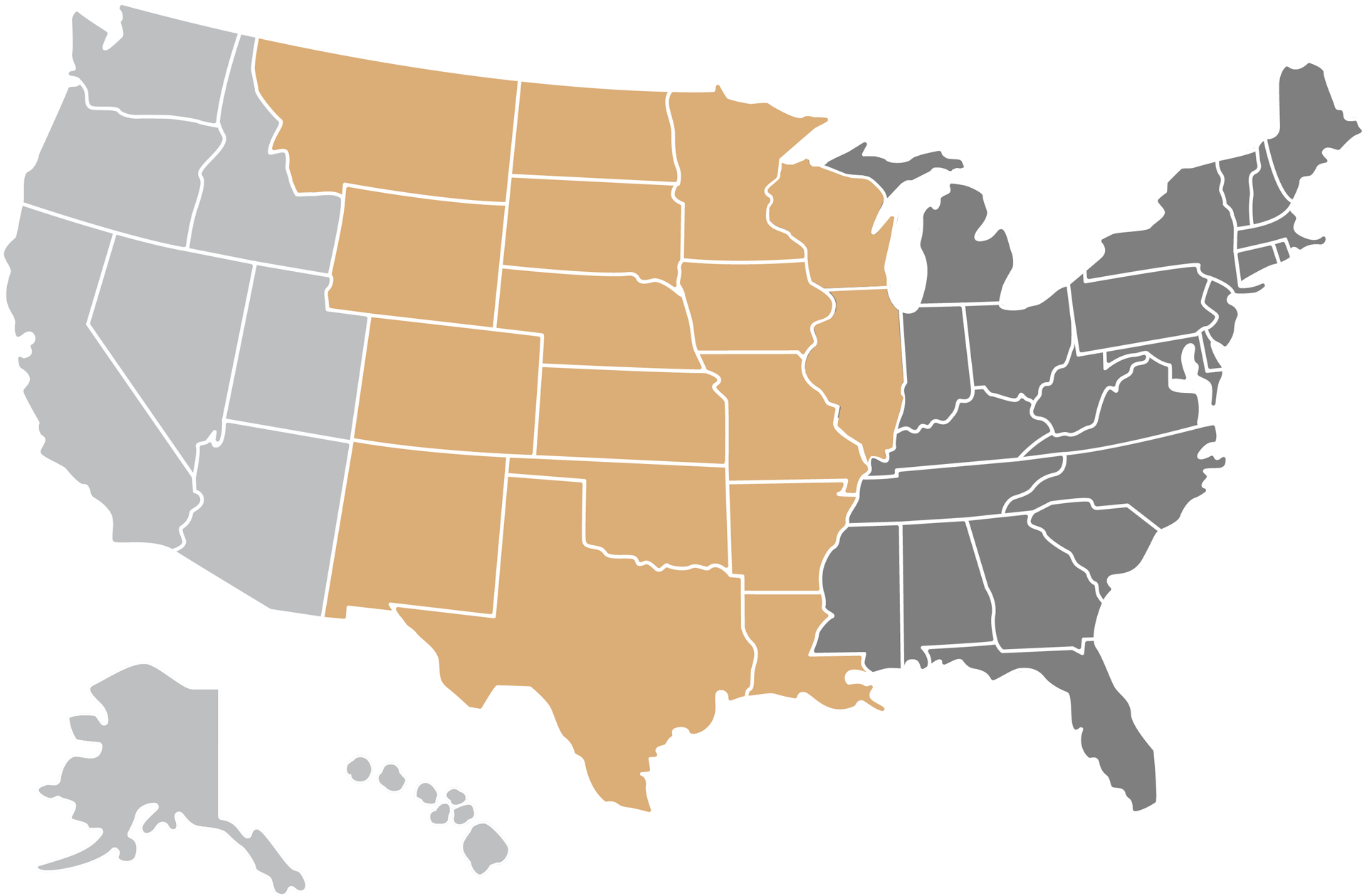

This fund injects capital into Qualified Opportunity Zones (QOZs) areas through commercial real estate projects, potentially bringing in new businesses, jobs and people to stimulate socio and economic growth.

If your clients rank environmental, social and governmental (ESG) impact as an important factor for investing, you should refer them to Caliber’s Opportunity Zone Impact Report to see real-life results. Its impact is updated quarterly.

ABOUT THE OPPORTUNITY ZONE PROGRAM

OPPORTUNITY ZONE CALCULATOR

A typical scenario is shown below. Input your own values to recalculate potential outcomes.

Upfront Load Fees:A sales fee or commission that an investor pays upfront at the time of the initial investment. This one-time charge eliminates the need to pay ongoing fees or commissions to a selling agent on that investment as time matures.

Disclaimer:This calculator is not a promise of future performance but a tool to illustrate the general tax advantages of investing in an opportunity zone versus a traditional investment. Investors are permitted to use their discretion regarding inputs to the calculator, but Caliber does not guarantee results from the calculator. Please consult with your tax attorney or accountant to determine whether the same tax advantages would apply to you and whether the assumptions herein are realistic for a particular offering. The tool makes several assumptions that may not be realistic for a particular offering; namely, that the relevant tax laws will not change over the life of the investment; that the investor is investing capital gains; that simple interest, not compound interest, is sufficient for illustrative purposes; that capital will not be used to pay distributions, thereby reducing working capital; that distributions will be paid at the targeted rate throughout the life of the investment; that the purchaser will hold the investment for at least ten years; and that the subject properties will appreciate in value at the same rate annually for the life of the investment. Finally, potential investors are advised that the taxes on the capital gains that constitute the original investment are deferred until December 31, 2026. Thus, taxes on the amount of capital gains invested will then become recognized and taxes will become due on or before April 15, 2027. Investments in private placements can lose entire value, are illiquid and are speculative.

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

Opportunity Zone Investment:

Traditional Investment:

INVESTOR Considerations

Selected risk factors are stated below. Refer to the PPM for more detailed discussion of risk factors.

- Investments in Caliber private placements can lose entire value, are illiquid and are speculative.

- Illiquid investment, uncertain time horizon, complex structure; suitable only for sophisticated investors;

- This investment does not comprise a comprehensive investment strategy;

- Investment returns are not guaranteed; this is a speculative investment;

- Unique risks related to real estate investment include interest rate risk, occupancy/extended vacancy issues, the ability to attract tenants, insurance risks, among others;

- This offering is not contingent on a minimum capital raise and if the Fund cannot raise substantial capital, Fund investments may be less diversified and the Fund may not achieve its investment objectives;

- Opportunity Zone provisions are technical and complicated; investors intending to qualify for opportunity zone incentive tax benefits must be mindful of meeting all requirements and are urged to consult their personal tax advisors regarding an investment in the Fund;

- COVID-19 could have a material impact on the Fund’s investments and operations.

For a more complete discussion of risk factors, view the Caliber Tax Advantaged Opportunity Zone Fund II, LLC PPM and supplement.

120-SKY-122023

Sign in or Sign up to view further offering details

Already have an account?

Log in Here

Speak to our VP of National Accounts

Overview Sheet

Please enter your information below to access the overview sheet.